As a leading fintech platform in the GCC, Tamara is at the forefront of understanding the evolving dynamics of consumer behavior. This report offers valuable insights into the shopping preferences and expectations of GCC consumers in 2024. By surveying over 1,700 respondents from Saudi Arabia and the UAE, we explore the key factors influencing how shoppers interact with brands, make purchasing decisions, and adapt to new payment technologies.

With these findings, we aim to provide a deeper understanding of the market landscape, reinforcing Tamara's commitment to shaping the future of shopping, payments, and banking in the region.

Who Participated in the Survey?

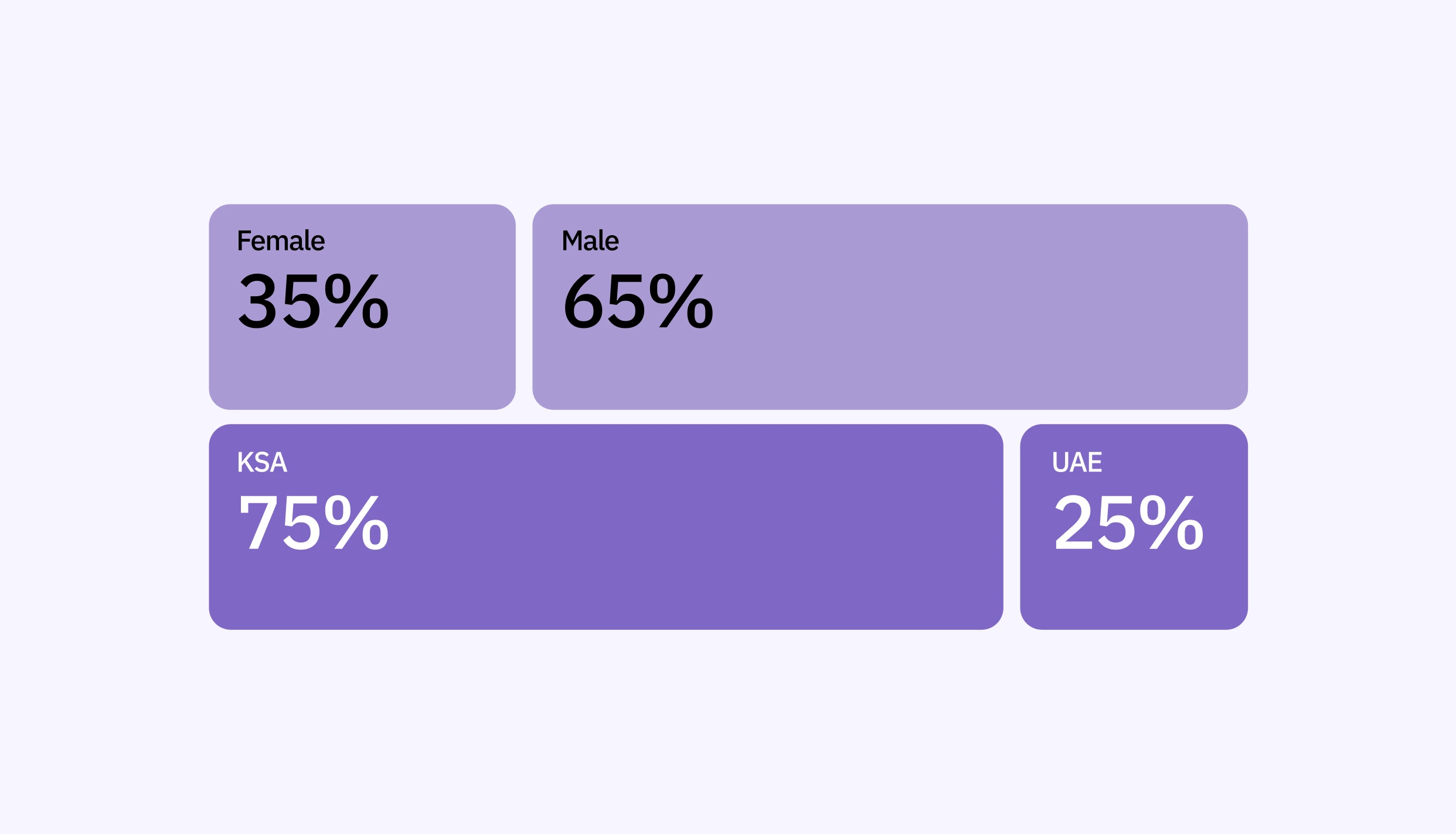

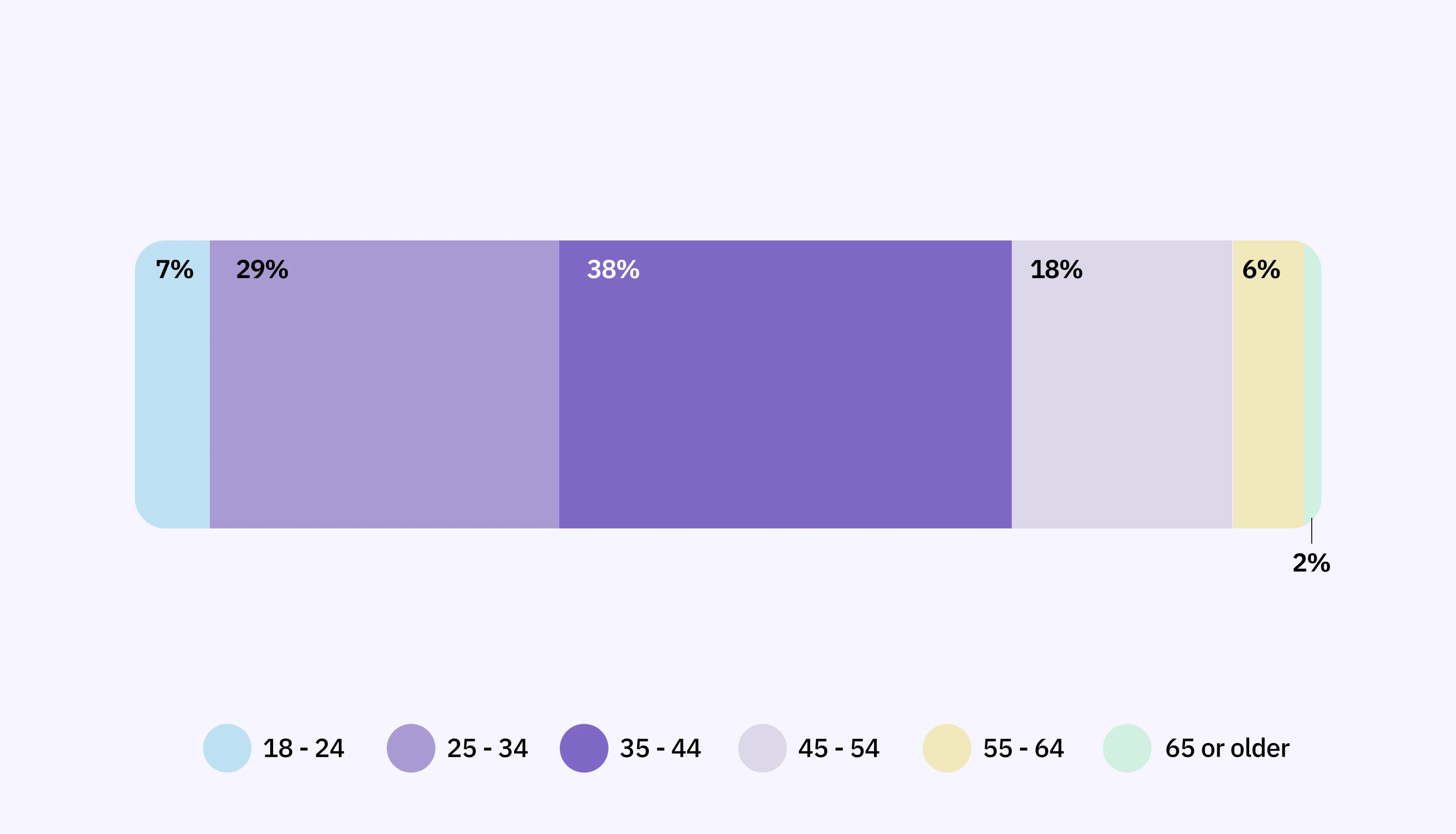

Our respondents hailed from Saudi Arabia and the UAE, two of the largest retail markets in the GCC. The group was mostly male (65%) with a strong female presence (35%). Respondents ranged from Gen Z to Boomers, but the most active age groups were 35-44 (38.4%) and 25-34 (29.4%). These findings help us understand who the decision-makers are in this evolving market.

Who Took Part in the Survey?

Generational Split of Survey Respondents

When Do GCC Consumers Prefer to Shop?

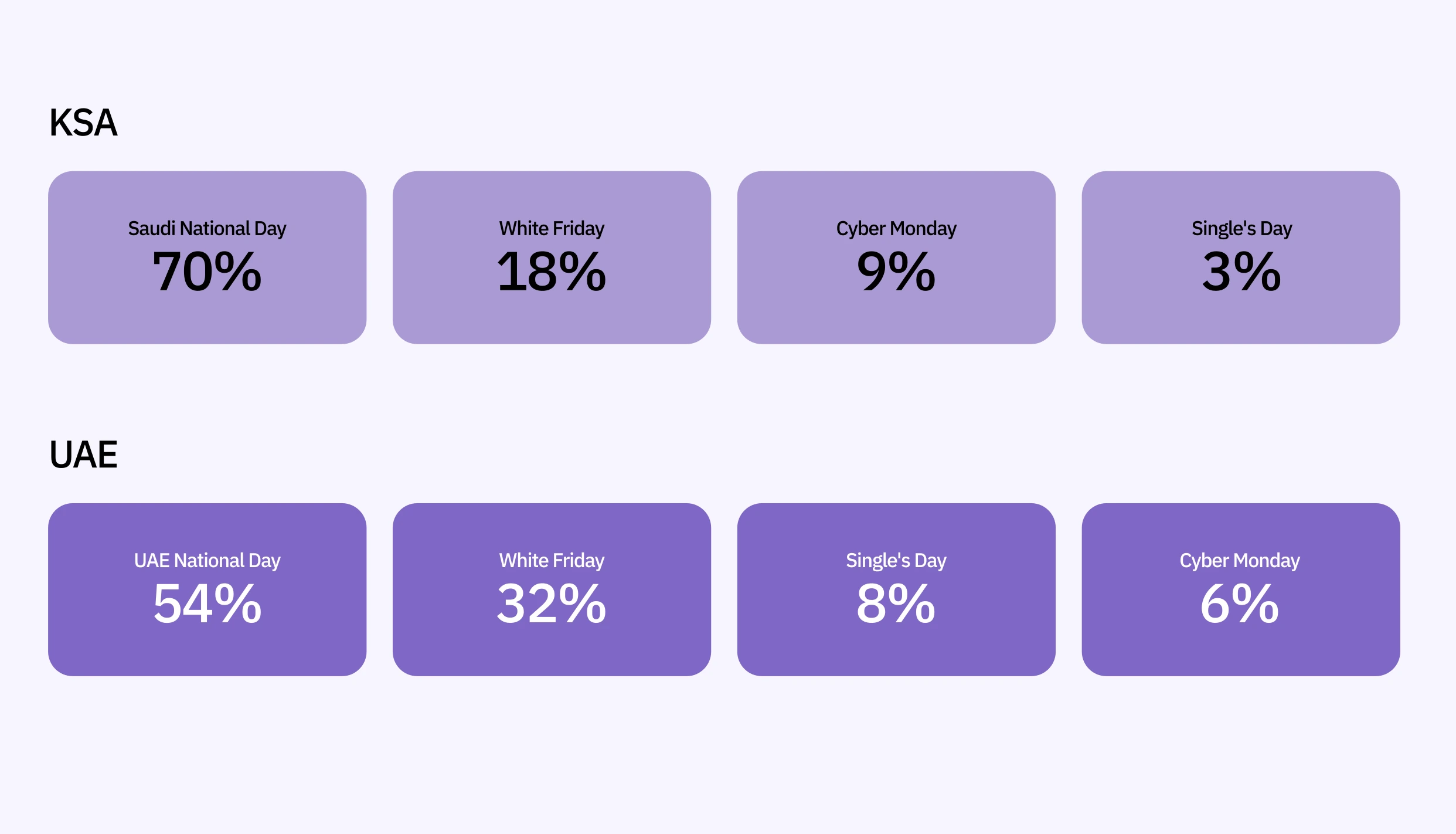

Shoppers in Saudi Arabia and the UAE are among the most enthusiastic consumers globally, contributing significantly to the GCC retail market, which accounted for 78.5% of the region's total in 2021. They love to make the most of key shopping seasons, with events like Saudi National Day and White Friday standing out as prime spending moments. According to Tamara’s survey, these high-shopping seasons offer retailers prime opportunities to capitalize on heightened consumer enthusiasm and spending. Interestingly, 46% of respondents reported that they plan their shopping in advance, indicating a strategic and intentional approach to shopping.

Most Popular Shopping Seasons in the GCC

Online or In-Store: What’s the Preference?

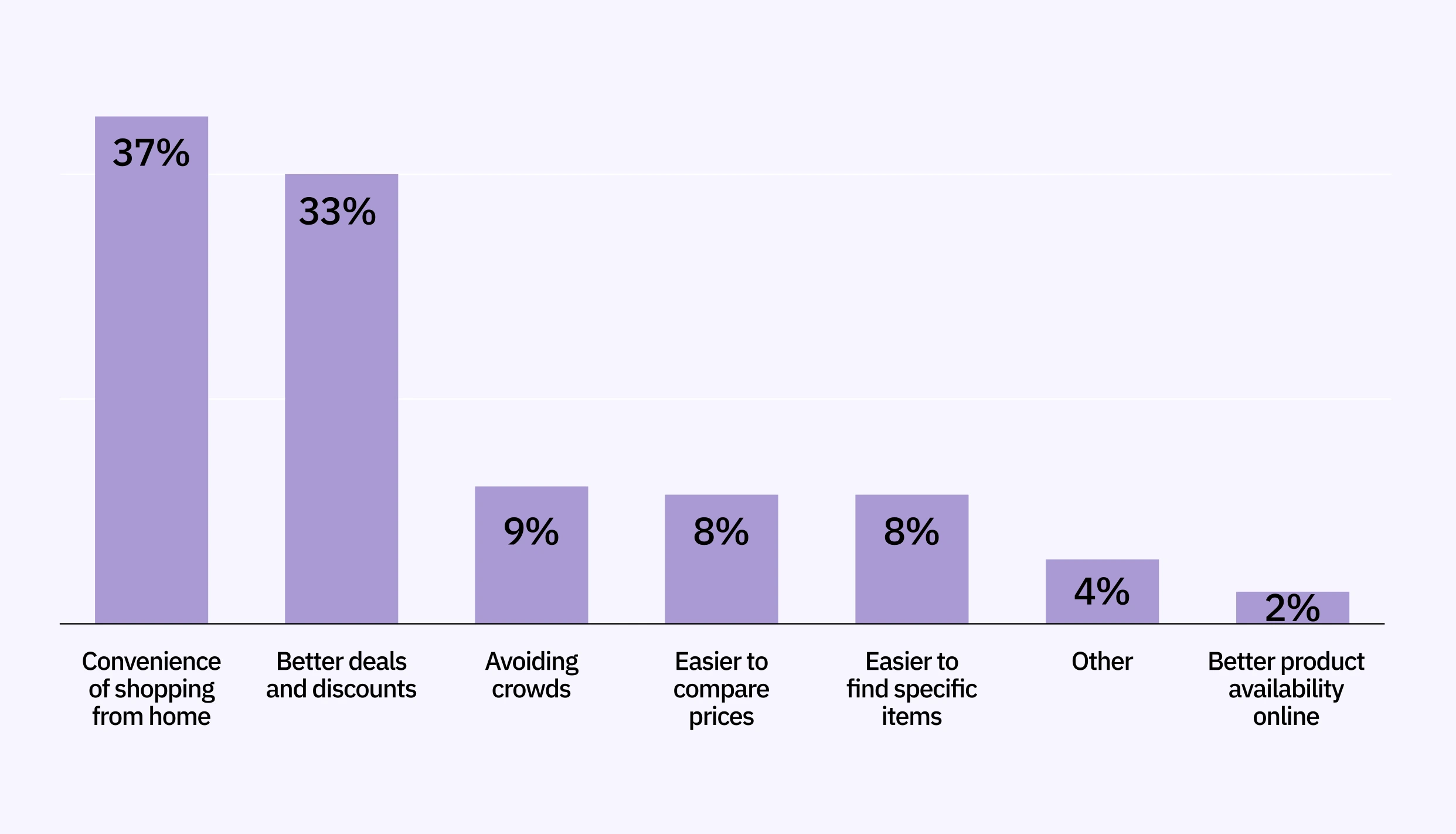

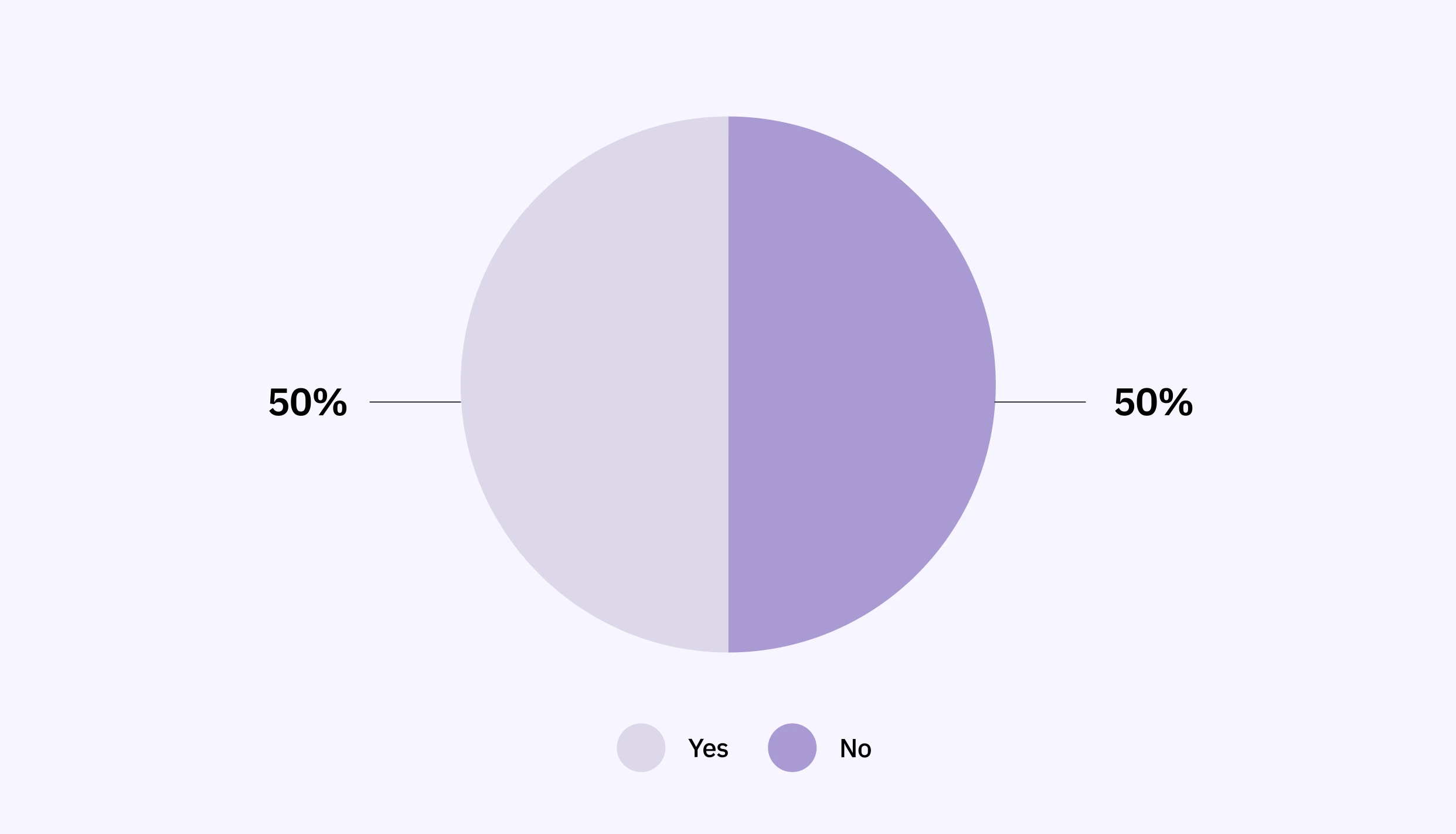

The question of online vs. in-store shopping has become a significant topic in the retail industry, especially post-pandemic. According to Tamara’s survey, a substantial 50% of shoppers prefer the ease of online shopping, while 43% enjoy a hybrid experience—shopping both online and in-store. The growing popularity of online shopping can be attributed to its convenience, 24/7 availability, and the ability to easily compare prices and products.

Despite the rise of e-commerce, physical stores still hold their appeal. Among those who prefer in-store shopping, 30% cite the ability to make immediate purchases as their primary reason, while 27% value the tactile experience of examining products firsthand. Notably, Tamara’s survey revealed that 50% of online shoppers still prefer to visit physical stores before making a purchase, highlighting the complementary nature of these two shopping channels.

Shopping Channel Preferences

Reasons Shoppers Prefer Online Shopping

Do Customers Visit Physical Stores Before Online Purchases?

Where Do Customers Hunt for Best Offers and Deals?

The customer experience goes beyond convenience—it's about finding the best deals. Our survey reveals that many shoppers are on the hunt for promotions, especially during peak shopping seasons.

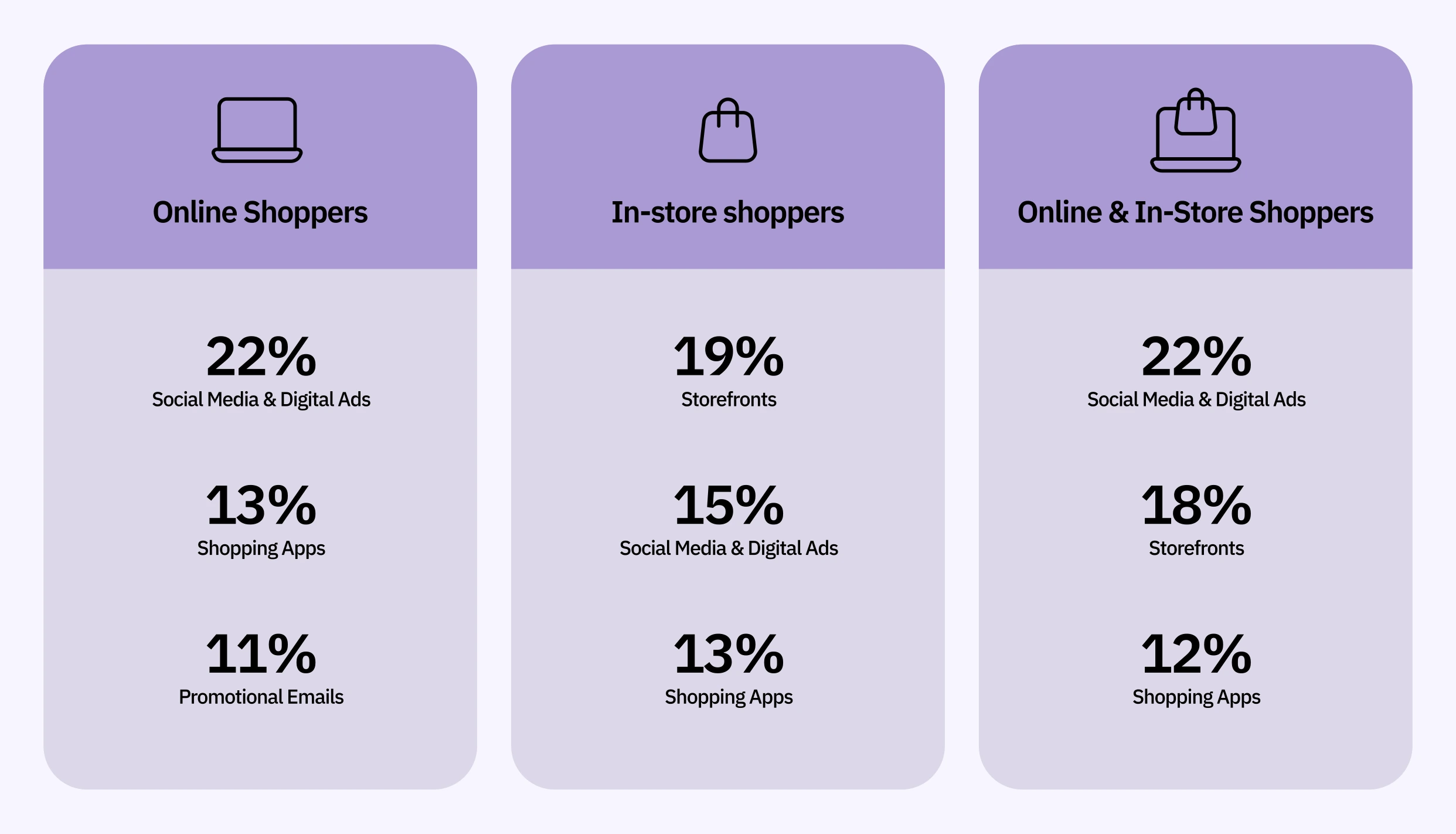

In a world where shoppers rely on social media, online ads, and apps to discover the best deals, it’s crucial for brands to meet consumers where they are. Securing the best possible deals is a top priority for almost all categories of shoppers, and the mission to locate these deals can be challenging amid high-season distractions.

According to Tamara’s survey, a significant portion of shoppers (46%) engage in price comparisons between online and physical stores, highlighting the importance of competitive pricing and transparent information to attract and retain customers during these peak shopping times. Even physical stores play a key role, especially for those who enjoy the in-store experience, with offers prominently displayed on storefronts serving as an important channel for in-store shoppers.

Top Channels for Discovering Deals

What Do GCC Customers Buy During Shopping Seasons?

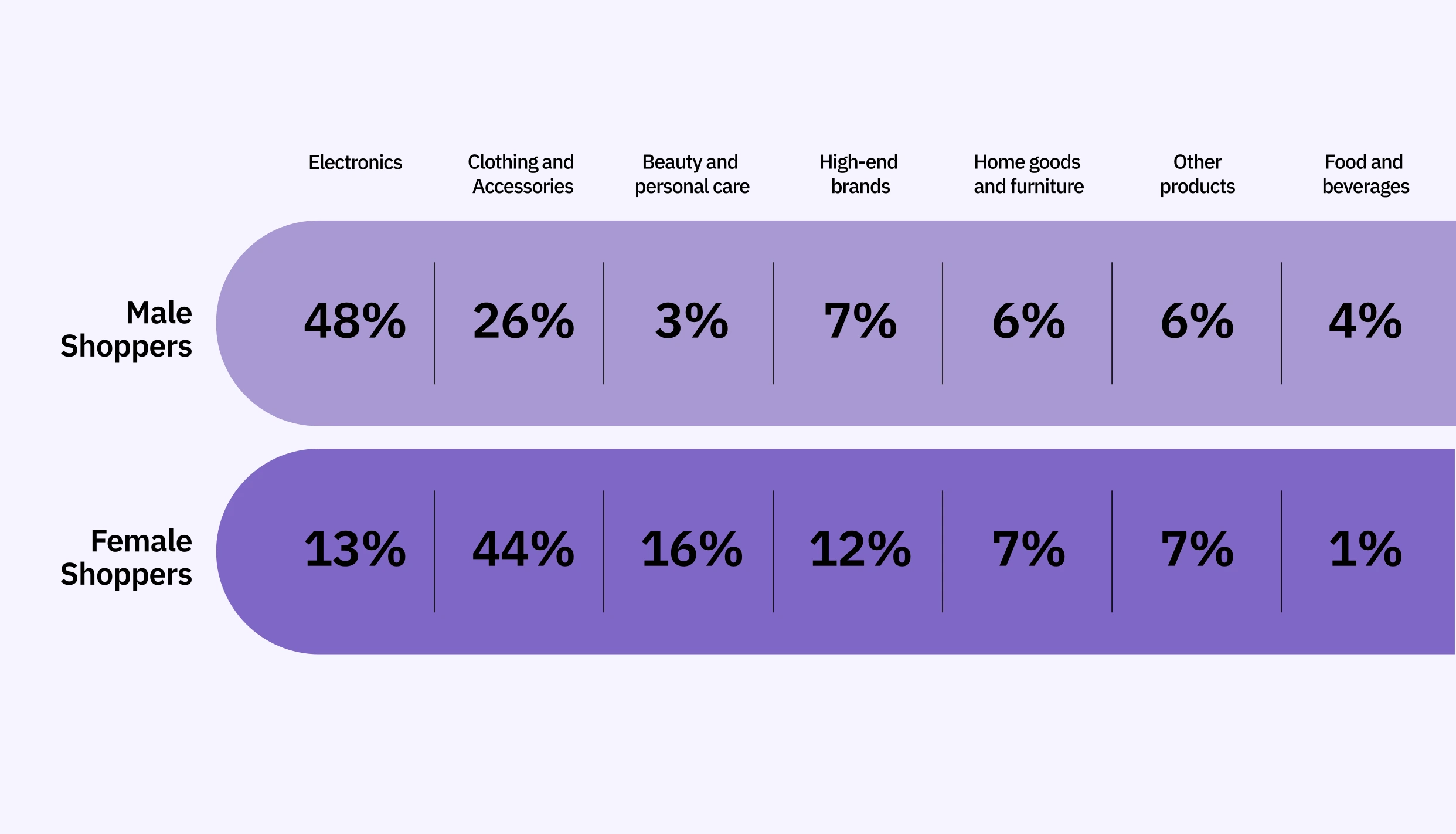

During peak shopping seasons, customers tend to spend more, particularly on electronics, clothing, and accessories. Our survey found that 54% of shoppers are willing to splurge on higher-end items during these times, making it essential for retailers to stock up on popular categories when consumer interest is at its peak.

The survey highlighted key differences in shopping preferences between genders. Male shoppers showed a clear preference for electronics, with 47.5% stating they primarily purchase these items during peak seasons. In comparison, female shoppers exhibited almost equal enthusiasm for fashion, with around 44% indicating they tend to shop for clothes and accessories during the same periods.

Most Popular Product Categories by Gender

How Are Customers Paying in 2024?

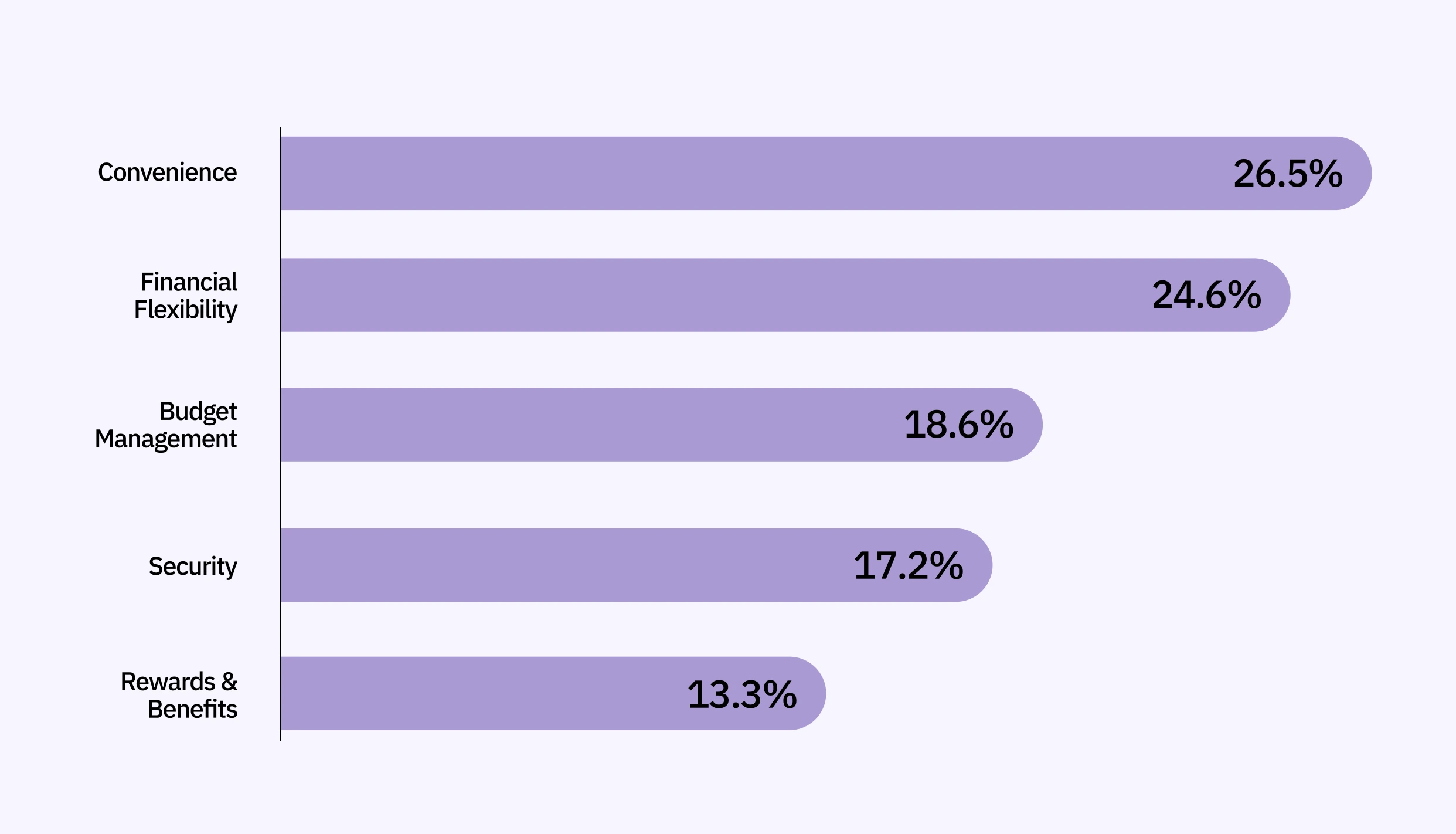

The future of payments in the GCC is clear: flexibility is king. Our survey found that 61% of shoppers now prefer split payment options like Tamara's over traditional cash or card payments. The key drivers? Convenience and financial flexibility. These options give shoppers greater control over their finances while making the shopping experience smoother and more enjoyable.

Why do shoppers prefer BNPL in 2024?

The Buy Now, Pay Later (BNPL) market is growing rapidly in the GCC, with a projected CAGR of 23.6% over the next eight years. As the demand for split payment options rises, it's becoming crucial for stores to offer BNPL solutions to meet customer expectations.

Join the BNPL Revolution

As you plan your next retail campaign—whether online or in-store—consider how flexible payment options can enhance the shopping experience for your customers. With Tamara, adding split payment solutions is easy and seamless. If you haven’t integrated Tamara yet, now is the time to delight your customers with the convenience they deserve.

Ready to elevate your business and redefine your customers’ shopping experience? Join us and make the smart choice with Tamara.